Artificial intelligence is no longer a promise of the future in the financial sector, but a reality that we are progressively and responsibly integrating into our processes. In a recent session held as part of the #KyndrylTalks series, Víctor Cuervo, Head of Architecture at Banco Sabadell, shared our perspective on the real impact of AI and, in particular, the role that AI agents are playing within organisations.

During the discussion, we explored how we are putting these agents at the service of our relationship managers, with the aim of providing them with access to specialised information, streamlining specific tasks and, ultimately, improving the quality of the service we offer to our customers.

What Is an AI Agent and Why Does It Matter?

An AI agent goes one step beyond traditional generative models. It does not merely respond to questions, but is capable of acting autonomously or semi-autonomously within a specific domain. This includes tasks such as querying structured information, generating contextualised responses or executing repetitive processes under predefined rules.

From our experience, AI agents represent a natural evolution of generative AI. They combine deep domain knowledge in banking, controlled access to data and execution capabilities, making them a key lever for transforming the way we work.

How They Differ from Traditional Assistants

While a chatbot-style assistant responds to a single query, an agent can orchestrate end-to-end workflows: gathering relevant documentation, preparing reports, proposing scenarios or coordinating with other systems. This significantly reduces operational workload for teams and frees up time for higher-value activities.

How We Are Applying AI Agents at Banco Sabadell

Our approach is highly practical and focused on real impact. We design and deploy agents specialised in different banking domains, always under strict security, traceability and regulatory compliance controls.

These agents act as direct support for managers in their day-to-day work, enabling faster access to relevant information and helping to execute tasks that previously required multiple steps or manual queries. As Víctor Cuervo highlighted during the session, the objective is not to replace professionals, but to enhance their productivity and improve service quality.

Some Use Cases at Banco Sabadell

- Automatic summarisation of complex documentation, to support decision-making.

- Preparation of personalised financial scenarios, tailored to each customer’s context.

- Assistance with administrative processes, particularly those requiring data verification and consolidation.

Benefits for the Organisation and for Customers

The introduction of AI agents delivers three clear benefits. First, speed, by reducing response and execution times. Second, consistency, ensuring homogeneous management aligned with internal criteria. Finally, scalability, enabling us to handle more cases without a proportional increase in resources.

For our customers, this translates into a smoother experience, more accurate responses and closer support from their relationship manager. This approach aligns with the AI-driven productivity vision we are developing and sharing through Sabadell Digital.

Challenges and Best Practices in Adopting AI Agents

Governance and Security

Agent design must be based on clearly defined boundaries: access control, action logging and continuous oversight. Security and the protection of financial data are non-negotiable.

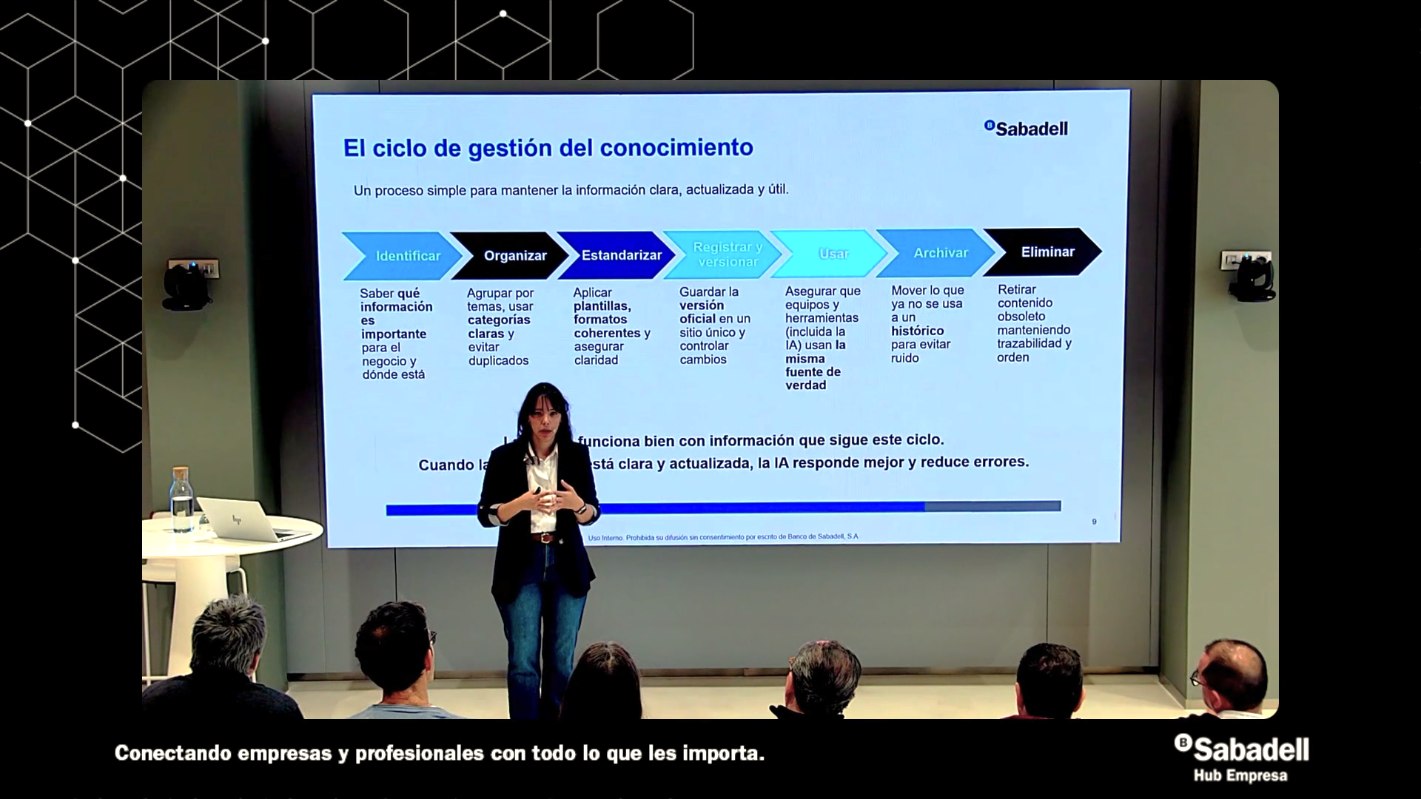

Data Quality and Training

An agent is only effective if it is built on high-quality data. That is why we invest in data curation, taxonomy definition and metrics that allow us to assess performance and reliability.

Human Oversight

We always maintain human-in-the-loop mechanisms to ensure that critical decisions are validated by a manager or responsible professional before execution.

At Banco Sabadell, we believe that the responsible adoption of AI agents is an opportunity to improve efficiency without losing focus on trust and service. The key lies in designing useful, secure and auditable solutions that complement human expertise and strengthen our value proposition. At Sabadell Digital, we continue to share insights and real-world cases on how technology is driving a more agile, efficient and customer-centric form of banking.